How much can i borrow on a shared ownership mortgage

Housing Authority co-own a share of the property with you lowering your loan amount. Shared Ownership Wales allows 25 to 75 of a housing association home to be bought by those unable to obtain the level of mortgage needed to buy a home outright.

How Much Can You Afford To Borrow On A Mortgage Forbes Advisor Uk

This typically costs about 1000.

. Our Shared Ownership Affordability Calculator will help to give you an indication of how much we could lend your clients. The loan is secured on the borrowers property through a process. Buying part of a property through shared ownership is one way of getting a foot on that first rung of the ladder a ladder thats become harder to climb as property prices continue to soar.

Sometimes taking out a joint mortgage could increase the amount you can borrow especially if you both have well-paid jobs. If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own. How much could you borrow.

Constitution Article I section 9 clause 7 states that No money shall be drawn from the Treasury but in Consequence of Appropriations made by Law. There are extra costs when buying a home including solicitors fees and mortgage arrangement fees. Mortgage tools and services.

Rent is paid on the un-owned share of the property. However mortgage affordability is subject to lots of different things such as your credit history monthly outgoings and deposit and it can also vary from lender to lender. When you buy a shared ownership home you buy between 25 and 75 of its value and pay rent on the rest.

Shared ownership is a type of mortgage. Offset calculator see how much you could save. Under the shared ownership program you can purchase a share of your home and pay rent on the remaining mortgage balance until it.

As of December 2020 the average home price in the UK was 251500. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Will be allowed the calculated percentage amount or the standard amount whichever is less.

Each year the President of the United States submits a budget request to. How much do houses cost. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

Deposit from as low as 2. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out. What is a Buy to Let mortgage.

Updated For January 2022. Yet while the concept of shared ownership is straightforward in practice it can be both complicated and expensive. Shared Ownership Wales.

Like any form of investment theres a lot to consider before you make the jump as. 754 Leaseholders wishing to borrow. You buy a share usually 25-75.

Affordability calculator get a more accurate estimate of how much you could borrow from us. Speak to a mortgage broker to find out how your situation could affect how much mortgage you can borrow. 351 Owner occupiers can access Shared Ownership subject to the following conditions.

This is a scheme that lets you buy a share of your property and pay rent on the rest. This guide sets out how the scheme works in England who can take part and. Choose a shared ownership home loan designed to help you get into a home of your own sooner.

A Buy to Let mortgage is a loan secured against one of these properties. The calculated percentage can also be applied to other shared expenses such as family health insurance. You can head to our Joint Mortgages page to find out more.

You can use your first home owner grant FHOG towards your deposit if you build. Shared ownership what were referring to on this website The same as Help to Buy. Its different to a residential mortgage as instead of buying the whole property you buy a share.

Get a rough idea of how much you could borrow for a residential mortgage based on your personal circumstances. No lenders mortgage insurance. Explore how mortgage interest rates work average mortgage rates how many mortgage deals there are and how to get the best rate.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. It takes about five to ten minutes. Shared Ownership is an affordable way to buy a property where you purchase a share of a house that suits you.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Credit card interest is the fee a card issuer can charge when you borrow money with your credit card. Shared ownership mortgage calculator.

Shared ownership is only available to first-time buyers those whove previously owned a home but cant afford to buy one now and existing shared ownership homeowners who want to move house. Find out how about the different types of mortgage the fees you might have to pay and how much a mortgage costs. Thats where shared ownership mortgages can help.

Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. You pay rent on the rest. Your household income must be less than 80000 if you live outside London or 90000 if youre living in London.

To qualify you must. How much can you borrow. Because banks play an important role in financial stability and the economy of a country most jurisdictions exercise a high degree of regulation.

Please get in touch over the phone or visit us in branch. Shared Ownership just with a non-branded name. If youre a first time buyer saving a big deposit can be tricky.

For more information about mortgage default on Shared Ownership. The amount you are able to borrow will help you determine the size. The taxpayer is required to provide copies of mortgage or rent payments utility bills and maintenance costs to verify the necessary amount.

Compare 12000 deals from 90 lenders and find a mortgage or remortgage deal thats right for you. The amount of interest charged depends on the cards annual percentage rate APR. You only pay a mortgage and deposit on the share you own.

Find out how much you can borrow with our mortgage calculator that scans over 20000 mortgages from 90 lenders to find real products you could be eligible for. And a regular Statement and Account of Receipts and Expenditures of all public Money shall be published from time to time. Simply tell us their basic information to get a maximum loan amount or if you know their commitments and expenditure include that to get a more comprehensive result.

Of course this depends on both parties circumstances and the addition of an applicant with very little or no income. For more information see the Shared Ownership Wales website. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Please call us to discuss. Youll pay a mortgage on your share then pay rent on the rest. Lending activities can be directly performed by the bank or indirectly through capital markets.

You buy a share usually 25-75. A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit. The amount of your deposit and how much you can set aside for monthly mortgage payments.

How Much House Can I Afford Calculator Money

How Much Can I Borrow On A Mortgage Based On My Salary

What Is Joint Borrowing Bankrate

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms

Family Loan Agreements Lending Money To Family Friends

Pin On Housing Market

Mortgage Loans Texas Credit Union Home Loan First Service

Can You Get A Mortgage As A Student 2022 23 Nuts About Money

First Time Buyer Guide How Much Can I Borrow Moneybox Save And Invest

Secured Vs Unsecured Loans Metro Credit Union

Can You Use Home Equity To Invest Lendingtree

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

How To Increase The Amount You Can Borrow My Simple Mortgage

How To Increase The Amount You Can Borrow My Simple Mortgage

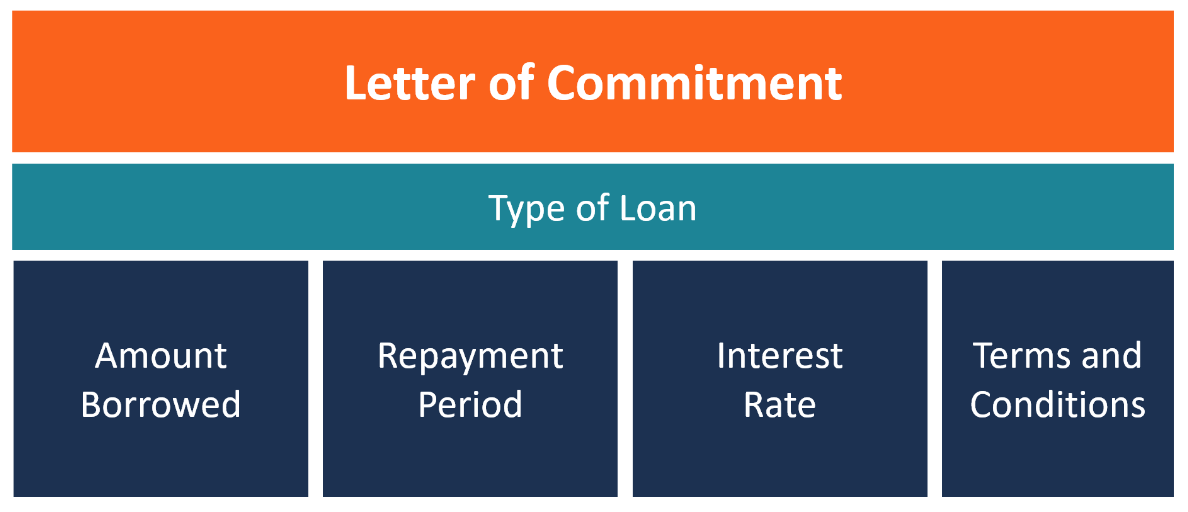

Letter Of Commitment Overview Example And Contents

Self Employed Mortgage Calculator Haysto